According to a Starbizweek report (28/8/21), global giants in cloud computing and hosting are looking at Malaysia to have their data centres. These include Amazon, Microsoft, Google and Tencent. Many of these global tech players have their data centres in Singapore. However, about two years ago Singapore began limiting approvals for HDCs. Why? HDC consumes large amounts of electricity, water and space.

What is a HDC? Some classify this as any data centre with at least 5,000 servers and 10,000 square feet of available space. Others focus less on physical attributes and more on “scale of business” criteria – company’s cloud, e-commerce and social media operations. There are almost 600 centres in the world.

The global market size of colocation data centres is estimated to reach US$92.4bil RM387.2bil) in 2025. Asia-Pacific alone will account for 50% of the global market by revenue and 40% by MW in 2025 globally.

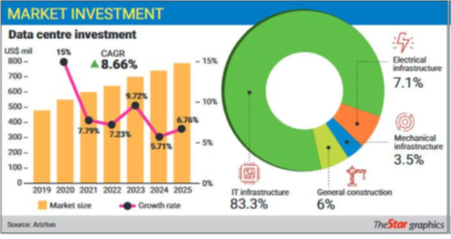

Dr James Tee of G3 Global Bhd says “Malaysia now has a one-in-a-lifetime opportunity. The global market size of colocation data centres is estimated to reach US$92.4bil (RM387.2bil) in 2025. Asia-Pacific alone will account for 50% of the global market by revenue and 40% by MW in 2025 globally,” he says. Adds Tee: “Malaysia is in an opportune position to be a part of this growth. Reports indicate that Malaysia can expect a compounded annual growth rate (CAGR) for HDCs of 13% between 2019 to 2025. This is supported by the fact that our domestic data centre industry revenue has been growing at a CAGR of 22% from 2011 to 2020.” (Starbizweek 28 August 2021).

Research outfit Arizton Advisory reckons that Malaysia’s data centre market size will reach revenues of a massive US$1.4bil (RM5.8bil) by 2026. The state of Johor is becoming one hotspot. Microsoft and GDS are among those building new HDCs there.

Johor appeals to some large tech players already in Singapore because of the availability of high data speed connections between Johor and Singapore. Lower cost is another obvious reason.

G3 Global Bhd said it plans to house the country’s largest HDC in the proposed Artificial Intelligence (AI) park in Bukit Jalil, starting with three 10MW hyperscale data centres in the first phase of development. At maturity, the data centres are meant to have a potential end state of 100MW.

There is a huge opportunity for AI to flourish in Malaysia and the government recognises its potential in the nation’s growth. Among the work-in-progress are securing data centre partners, equipping the park with 5G technology and securing strategic investors.

But Malaysia is not alone in trying to woo such investments. Aside from Singapore, which is the data centre hub in the region, Indonesia and Thailand are also in the running for this business.

A recent research report notes that the Indonesia data centre market was valued at US$1.5bil (RM6.28bil) in 2020, and it is expected to reach a value of US$3.07bil (RM12.86bil) by 2026, registering a CAGR of 12.95% over 2021 to 2026. The report indicates that the potential for data centre growth in Indonesia is significant as the country is witnessing a growing digital economy, coupled with the rapid growth of startup companies and an ever-growing population.

The Thailand data centre market includes about 14 unique third-party data centre service providers, operating more than 30 facilities. In addition, there are also several on-premises or dedicated data centres owned by local enterprises.

Detractors caution that simply opening up Malaysia’s shores to large foreign tech giants to set up their HDCs here brings questionable value. These detractors who are from the local data centre industry, worry that Malaysia would end up becoming a “HDC sweatshop”. They point out that HDCs do not hire many people, due to the highly automated nature of the systems. Another concern is a huge amount of the investment actually goes out of Malaysia as the HDC would be purchasing computer hardware and software that isn’t made in Malaysia to be placed into the HDCs here.

Whatever the case, on balance, if FDIs move into Malaysia that is a positive development (amidst the gloom of negative news). Will MITI or MIDA work harder to secure these investments? Otherwise, Indonesia or Thailand will prove more alluring!

Reference:

Striking while the iron is hot, Zunaira Saieed, Starbizweek, The Star, 28 August 2021

No comments:

Post a Comment