Thursday, 31 October 2024

Wednesday, 30 October 2024

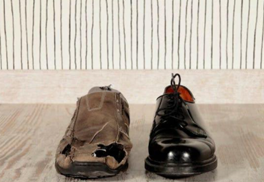

Does the Top 1pct of the Population Own 50pct of Wealth?

An axiom quoted often is that one percent of the world owns 50 percent

of the wealth. It holds enormous policy implications, for both the world and

Malaysia. At the most basic level, it means a considerable adjustment in wages.

And it needs a major reform that will tax the rich at much higher levels than

they have been used to.

Oxfam, which works with 21 NGOs that have partners in over 90 countries, accepts and promotes this axiom. In a briefing paper titled “Survival of the richest: How we must tax the super-rich now to fight inequality”, it said the richest one percent hold 45.6 percent of global wealth, while the poorest half of the world has just 0.75 percent.

Source: https://www.wikiimpact.com

Since 2020, the richest one percent have captured almost two-thirds of all new wealth – nearly twice as much money as the bottom 99 percent of the world’s population. The gap is widening.

A deeper dive reveals the following:

· Billionaire fortunes are increasing by US$2.7 billion a day, even as inflation outpaces the wages of at least 1.7 billion workers, more than the population of India.

· Food and energy companies more than doubled their profits in 2022, paying out US$257 billion to wealthy shareholders while over 800 million people went to bed hungry.

· Only four cents in every dollar of tax revenue comes from wealth taxes.

· Half the world’s billionaires live in countries with no inheritance tax on money they give to their children.

· A tax of up to five percent on the world’s multi-millionaires and billionaires could raise US$1.7 trillion a year, enough to lift two billion people out of poverty and fund a global plan to end hunger.

· Eighty-one billionaires hold more wealth than 50 percent of the world combined.

· Ten billionaires own more than 200 million African women combined.

Each of these bulleted points is outrageous. This situation needs to be rectified. Otherwise, a popular revolution on the ground will happen.

For comparison, labour’s income share in the European Union’s “Big Four” in 2021, namely Germany (61.4 percent), France (59.8 percent), Spain (59.1 percent) and Italy (58 percent) was much higher, an indication of the long way we have to go in terms of wage reform and giving labour a fairer share of GDP.

The only way to do this as quickly as possible is to progressively keep increasing wages at a rate that the economy can bear. That will also mean the tough decision of cutting off access to cheap foreign labour. And the people who use this cheap labour will cry out loud.

The other thing that the government needs to do is increase taxes at the top bracket for those earning billions of ringgits. Why does the marginal rate for these people have to remain at 28 or 30 percent? Why can’t those who earn more than RM5 million a year be taxed 40 percent on the margin? And those who earn above RM10 million annually are taxed 45 percent, and so on.

As Oxfam points out: “Taxes on the richest used to be much higher. In the United States, the top marginal rate of federal income tax was 91 percent from 1951 to 1963; top inheritance tax rates stood at 77 percent until 1975; and the corporate tax rate averaged just above 50 percent during the 1950s and 1960s.

The problem with all of this is that, no one nation wants to raise taxes, as they view cutting taxes brings in new investment. So, it has been a race to the bottom. Perhaps, it is time to work together to raise taxes, reduce inequalities and provide a decent standard of living for the B40 and M40.

Reference:

Comment: When 1pct of population owns 50pct of wealth, P. Gunasegaram, Malaysiakini, 8 October 2024

Tuesday, 29 October 2024

More REIT Listings?

The local stock exchange could see an increase in Real Estate Investment Trust (REIT) listings. This is a promising opportunity for investors seeking stable and lucrative investments. REITs provide diverse portfolios spanning sectors such as retail, office, industrial, and hospitality, effectively reducing risk and insulating against market volatility in any one sector. Analysts predict that more property developers in Malaysia may turn to REIT listings.

RHB Research noted that this

trend is likely to continue, especially as declining interest rates generally

benefit REITs, particularly for companies with a substantial pool of investment

properties. Among the developers eyeing

REIT listings are IOI Properties Group Bhd (IOIPG) and SP Setia Bhd.

Source: https://en.wikipedia.org

Sime Darby Property has built a significant cache of retail assets, including KL East Mall, which now yields 6.5 per cent to 7.0 per cent after three to four years of operation, Senada Mall, set to open in the second half of 2025, and Elmina Lakeside Mall. In the logistics sector, Sime Darby Property's Metrohub in Bandar Bukit Raja is gaining momentum. Metrohub 2 is complete, with tenants Comone Express and JD Logistics occupying 25 per cent of the 800,000 square feet space, with room for expansion.

Meanwhile, Metrohub 1, expected to complete by the fourth quarter of 2024, has already secured 50 per cent occupancy, covering 1.1 million square feet of net lettable area (NLA). By the first half of 2024, Sime Darby Property had accumulated 7.7 million square feet of NLA in investment properties, two million of which are industrial properties.

RHB Research valued the company's total assets under management at RM2.6 billion (excluding concessions) as of fiscal year 2023. The completion of the Google Data Centre (DC) in 2026 is expected to further enhance Sime Darby Property's asset portfolio by an additional RM1.5 to RM2 billion. The company's property investment, leisure, and hospitality segments currently generate an annualised revenue of approximately RM220 million, RHB Research said.

It is good news for retail

investors as they have a better opportunity to invest with yields above 6% p.a.

This is an attractive option compared to fixed deposits or other fixed income structures.

Hopefully, market sentiment continues to improve and create opportunities for

REITs.

Reference:

More

REIT listings anticipated in Malaysia, Sharen

Kaur, NST, October

14, 2024

Monday, 28 October 2024

When Do Gifts Become Crimes?

Singapore is well known for its good reputation on

public service. In order to uphold a clean image, public officials are paid the

highest reasonable salary to ensure integrity and fairness. So, there are high

expectations of their integrity, loyalty and unblemished conduct.

Source: https://upload.wikimedia.org

The recent court proceedings and sentencing of Iswaran were remarkable for their clarity, celerity and civility. There was an almost understated, chilled, circumspect cultural panache about it.

When first

accused and charged with corruption in January this year, Iswaran vehemently

maintained his innocence and indicated he would fight the charges strenuously. A

lesser charge of the acceptance of gifts, despite partial disgorgement and the

obstruction of justice elements, was somewhat conveniently agreed to by the

accused.

The judge gave a rational and well-reasoned verdict in sentencing Iswaran. Beyond the judgment, it demonstrated the state’s superb efficiency and expeditiousness in dealing with an awkward episode. All this was done within a span of nine months.

Here in Malaysia, cases involving a former prime minister who left office in May 2018 are still ongoing. While one case has concluded with imprisonment and a fine, other cases continue. The trial, conviction, sentencing and imprisonment of the former prime minister in the previous case went through a hierarchy of the higher courts over a four-year period. The former Prime Minister and his counsels continue to speak of a gift as if it had dropped from heaven. They claim the gift was from a foreign party with the former PM suggesting it was a respectable and rewarding token for his exceptional personal standing.

No criminal

trial involving any individual, whatever his or her status, should be bogged

down by processes. Couldn’t we learn from Hong Kong and Singapore? Could we not

have a special Corruption Practices Court to dispense cases expeditiously? And

stop this idea of house arrests.

Reference:

When

gifts become crimes: From minister to inmate in Singapore, M

Santhananaban, ALIRAN, 8 Oct 2024

Friday, 25 October 2024

Engineering the Future?

Data shows that the number of students registering for STEM-related courses has fallen to 35% as at end-2022 from 38% in 2017. At the same time, the number of graduates from STEM-related fields has declined from 39% in 2017 to 36% in 2022.

According to the latest available data, as at April 30, 2023, the number of Form 4 students enrolled in the science stream had declined to 74,180, or roughly 18.8% of the entire Form 4 student population, from 92,956 students, or 23.7%, in 2017.

A similar trend can be observed for Form 5 students, as enrolment in the science stream had slipped to 70,497 persons, or 19.4% of the entire Form 5 student population, as at April 30, 2023, from 93,345 persons, or 23.23% in 2017.

Industry experts and educators say the declining interest in STEM-related subjects is a multifaceted issue: from the perception of STEM being difficult academically to the lack of parental encouragement as well as the unattractive remuneration.

In Penang, fresh graduates in engineering can command a starting salary of RM3,800 to RM4,000. Those in more niche sectors such as integrated circuit design are paid a substantially higher salary of about RM6,000. The state is an outlier, though, as engineers in other parts of Malaysia do not enjoy such salaries.

On Sept 8, the Penang STEM Talent Blueprint was officially launched to address the need for a long-term talent supply pipeline and skills development for its STEM workforce in support of the New Industrial Master Plan 2030 and the National Semiconductor Strategy (NSS).

Developed by the Penang STEM Working Group, the blueprint comprises InvestPenang, Penang Institute, Penang Skills Development Centre (PSDC), Motorola Solutions, Pentamaster Corp Bhd and Intel Corp. It aims to build a highly skilled and sustainable STEM workforce to propel Penang towards long-term success in a rapidly evolving industrial and technological landscape.

It is estimated that, between 2025 and 2030, the total funds required for STEM initiatives is RM49.5 million per year, with 55.6% to come from the federal government, 31% from the state government and 13.4% from the industry.

“A bad curriculum well taught is

invariably a better experience for students than a good curriculum badly

taught: Pedagogy trumps curriculum. Or, more precisely, pedagogy is a

curriculum, because what matters is how things are taught, rather than what is

taught.” (LeapEd’s Nina Adlan Disney)

Hopefully, Penang will get it right to show other states the way forward for STEM. We can’t depend on MoE, because it is always in denial!

Reference:

Cover Story: Engineering the future, Liew Jia Teng/Esther Lee, The

Edge Malaysia,

10 October 2024

Thursday, 24 October 2024

Ratan Tata: A Life Well Lived!

Ratan

Tata, the titan of Indian industry, passed away recently, and Mumbai chose to

pause its celebrations of Navratri. This is a gesture so profound in its

spontaneity that it speaks volumes about what true leadership means.

This wasn't just the passing of a business leader; this was

the loss of a man who embodied the soul of ethical leadership. Consider the

contrast: When Steve Jobs, undeniably a visionary, passed away, America

continued its regular rhythm. But when Ratan Tata departed, Mumbai's millions

voluntarily halted their celebrations. The difference lies not in their

achievements, but in how they touched the hearts of common people. What makes

this gesture so remarkable is its authenticity. It wasn't mandated by any authority

or prompted by official declarations. It was the pure, unprompted response of a

population that recognized true greatness - not in wealth or power, but in

character and compassion.

Source: https://en.wikipedia.org

Ratan Tata's legacy wasn't just about building a business empire; it was about building trust, fostering dignity, and maintaining unwavering ethical standards. He showed that greatness isn't about being the richest or the most powerful - it's about being the most human. His leadership style wasn't about commanding attention but about earning respect through consistent actions that put people first.

The true measure of a leader isn't in the

grandeur of the celebrations they host, but in the sincerity of the silence

that falls when they depart. It's not about the parties thrown in your honour,

but about the moments when people voluntarily stop their own celebrations to

honour your memory. This spontaneous tribute to Ratan Tata reminds us that real

leadership transcends balance sheets and boardrooms. It lives in the hearts of

people who may never have met you but whose lives were touched by your values,

your decisions, and your way of being.

For aspiring leaders, this is perhaps the most important lesson: Aim not to be remembered for your parties, but to be mourned for your principles. Strive not to be celebrated for your success, but to be remembered for your service. Work not to be the richest in the room, but to be the most respected in people's hearts.

If only more of us were to do this, will not the world be a

better place? And you could have made a difference! So, don’t wait to be a

billionaire but share your RM10 or RM20 with someone who desperately needs it

today!

Reference:

Alok Tripathi’s Post, Linkedin

Wednesday, 23 October 2024

Budget 2025 Highlights

Our Prime Minister, also the Finance Minister tabled the Federal Government 2025 Budget last Friday, 18 October 2025 with a total allocation of RM421 billion. This is a RM27.2 billion increase from the budget for 2024. Here is the brief comparison of the Budget for 2024 and 2025:

Budget 2025 has these key pillars:

There are some good points on income re-distribution but the dividend

tax on individual shareholders will impact owners of SMEs. The FM has also

focused on irrelevant, non-income generating institutions like Jakim. Then, as

usual, he left the minorities with “crumbs” and expect their support in the

next election. The other is the T15 thing! Confusing and unclear! Why can’t

they enjoy some subsidy when they contribute bulk of the taxes (personal)?

References:

Centre Stage: Budget 2025 Overview, PwC

Malaysia

Budget 2025 Highlights, BDO, 18 October 2024

Tuesday, 22 October 2024

Household Income is Rising Disproportionately!

Clean

water, steady electricity supply, property sanitation and a solid roof over

one’s head. These are necessities. Under the 12th Malaysia Plan (12MP), the

Malaysian government aimed to construct 500,000 affordable housing units. A

total of 69.3% of its goal was achieved by September 29, 2024. The

2024 Budget further saw the completion of 19 new People’s Housing Programme

(PPR) projects that provided 6,006 units benefiting 24,000 low-income

households.

Real Estate

and Housing Developers' Association Malaysia (Rehda) Institute defines

affordable housing as units priced between RM200,000 and RM500,000, catering to

specific target markets and locations. As for affordability itself, Bank Negara

Malaysia (BNM) considers a house affordable if its cost does not exceed 30% of

an individual’s gross monthly income. Price-to-income ratios are not to be

higher than 3.0, but in recent years it has spiked to more than 4.3.

Additionally, households today report being over 85% in debt.

Source: https://www.wikiimpact.com

Malaysia has experienced a significant shift towards urbanisation, with nearly 78% of households residing in urban areas in 2022, up from 67% in 2002. This urbanisation, however, has not been accompanied by a uniform distribution of economic prosperity.

A possible initiative discussed is for the state government to purchase houses from the open market and rent it to those who cannot afford it. This is in strategic areas such as urban or developed locations. (Have a review of the Australian Model).

Another idea by Rehda is the setting of up a national affordable housing trust for developers to contribute a certain percentage of their gross development value (GDV) for affordable housing construction. The tradeoff, however, would be that the responsibility of building affordable housing will solely rest on the government’s shoulders.

To facilitate the purchase of affordable housing, banks could implement several measures. One such measure would be to offer 100% margin loans to purchasers, eliminating the need for a down payment. Additionally, banks could absorb interest payments during the construction stages, reducing the financial burden on buyers. Furthermore, allocating 30% of their loan portfolios to affordable housing initiatives would demonstrate a commitment to providing accessible homeownership opportunities.

Another potential strategy to support affordable housing involves providing financing of up to 110% of the property value. This would enable buyers to cover additional costs, such as renovation or furnishings. To prevent speculative buying and ensure that the property remains affordable for first-time homebuyers, a resale moratorium of ten years could be imposed.

Malaysia's

housing market has long been a vital economic sector. The nation must have a enough

supply of reasonably priced housing as its population rises.

Reference:

Household income rising disproportionately with house prices, Samantha Wong, Star Property, The Star, 11 October 2024

Monday, 21 October 2024

Can Pigs Fly?

It may not be too

extreme to regard Prime Minister’s recent plea for former leaders to return their ill-gotten wealth as nothing more than a sandiwara (opera). It is a

nice thought. But do these leaders have any sense of responsibility? If they

did, they wouldn’t have indulged in an act to impoverish their motherland.

The very idea that

they suddenly feel a rush of guilt and transfer the money back to Malaysia is

nothing but fantasy. Further, these funds have been spent on private jets or

luxury real estate.

It is just “blame

the past”. It’s much easier to shift the focus to corrupt former leaders than

to admit and implement real, meaningful reforms. It may buy political goodwill

without actually solving anything. Even fancifully if some do return the loot, Malaysia

may still squander. What assurances do we have that the returned loot would be

managed any better this time around?

If anything, it

might just disappear into the same bureaucratic black hole where public funds

go. There’s no real guarantee that the rakyat would benefit from it – and more

likely – we’d be left wondering where it all went – again.

Source: https://en.wikipedia.org

PM’s call also comes

with a layer of irony. Has anybody been charged for the RM9 billion littoral

combat ship (LCS) scandal?

If we’re dead

serious about preventing future corruption, the focus needs to be on

strengthening institutions, tightening oversight and implementing policies that

close off the avenues for financial misconduct. And more importantly have

people with proven integrity in places of power.

If we truly want to

move forward, we need to focus on building a system where corruption is no

longer possible, not just hoping that former crooks will do the right thing

after years of doing the opposite. Look at Singapore, a Minister goes to jail

for merely accepting tickets to a concert!

Reference:

PMX’s good intent

for past leaders to return the loot: Only if pigs could fly, Jonathan Liew, Focus Malaysia, 8 October 2024

Friday, 18 October 2024

Ringgit Appreciation: Correction or Anomaly?

The ringgit’s recent strong rise against the US dollar has overshadowed the local note’s performance against regional currencies. The ringgit’s performance versus the greenback has been rather extraordinary this year, outdone only by its appreciation against the Japanese yen, Korean won and Indian rupee. It has also strengthened measurably against the Singapore dollar, the Chinese yuan, the Hong Kong and Australian currencies as well as the Thai baht.

Some predict the Malaysian currency’s strength to be

sustained in the near term, with full-year gross domestic product (GDP) growth

expected at 5% to 5.5%, coupled with the pickup in the semiconductor sector and

consumer demand remaining strong.

Source: https://forexmalaysia.com.my

Budget 2025 will likely support continued growth, and

while the US presidential election may introduce short-term volatility, it is

unlikely to derail Malaysia’s long-term growth prospects.

Some also believe the ideal and stable exchange rate

based on long-term fundamentals would be RM4.20 to RM4.40 against the

greenback.

The primary difference between the depreciated standing

of the ringgit in February and its current level is expectations related to the

US federal funds rate (FFR) cut. If the FFR cut is bigger than expected, then there

are growing expectations for an appreciation. But appreciation (of the ringgit)

currently is linked to expectations rather than real economic factors. Nothing

has really changed in the real economy since early 2024. Some observe that

export figures have remained robust despite the appreciating ringgit. But this

is probably export of finished electronic goods.

So,

is it a market anomaly or a correction? Correction to an extent and anomaly if

currency traders change their expectation. The Madani Government must put in

place reforms, reduce the differential with FFR, encourage investments, reduce

bureaucracy, sustain domestic consumption and keep inflation in check! Sounds

like a tall order, but the reality is we are competing in the global

marketplace.

Reference:

Gaining

ground in the region, Keith Hiew, Star Biz7, The Star, 5

October 2024

Thursday, 17 October 2024

Has the Government Fulfilled Budget 2024 Promises?

The image below is extracted from the article in Malaysiakini as titled above (8 October 2024) which explains the status of promises made in Budget 2024:

The

easy ones seem to be fulfilled. It is the more difficult ones that require more

time. It is good for the Finance Minister to explain why he was not able to

fulfill the difficult ones and when he could see the resolution of the same. I

like the infographics and explanation done by Malaysiakini. If only the Budget

is presented similarly!

Reference:

Has

govt fulfilled Budget 2024 promises?

Malaysiakini, 8 October 2024

(https://newslab.malaysiakini.com/budget-2025/en/progress/)

Wednesday, 16 October 2024

Better Fiscal Discipline in 2025?

Under Budget 2024, the government had proposed to spend some RM90bil, which would likely leave some RM56.1bil to be spent for the second half of 2024 (2H24), as some RM33.9bil was spent in the 1H24. Hence, for Budget 2025, leaving everything else unchanged, the government should be tabling a gross Development Expenditure (“DE”) of approximately RM92bil.

Government revenue is projected to be much higher than the revised projection of RM312.1bil that was presented in March this year. The government’s revenue is expected to jump to RM321.5bil this year, an increase of 2.1% year-on-year (y-o-y). The increase is expected as economic growth this year is poised to hit close to 5% GDP growth.

On the same

token, expenditure (operating) too will likely be higher at about RM317.5bil,

Malaysia will likely show an operating surplus of RM4bil this year. This will

lead to a budget deficit of RM85bil, translating to a marginally smaller budget

deficit of 4.4%. The lower deficit is also due to accelerated expansion in the

nation’s nominal GDP, which is expected to increase to RM1.95 trillion in 2024,

up 7% y-o-y (1H24 increase was 6.3% y-o-y).

With the Malaysian economy poised to meet the 4% to 5% GDP growth target set for 2024, Budget 2025 will likely forecast higher economic growth, with a potential range of between 5% and 5.5%.

The growth will be underpinned by public and private investment. Higher private consumption will likely be driven by higher minimum wage and increase in civil service pay packages. On the flip side, there could be an added burden to consumers in the form of higher consumer price. The gradual increase in the price of RON95 fuel will have some knock-on effect. Inflation may hover between 2% to 3% given the price pressure from the removal of fuel subsidies.

For 2025, the government’s revenue is expected to surge to RM342.5bil, up 6.5% y-o-y, on the back of higher tax collections, especially with the implementation of e-invoicing and the GMT. Expenditures are expected to rise at a slower pace of 2% to reach RM324bil, giving a surplus of RM18.1bil.

As the government’s finances are expected to be better next year, despite a marginally higher gross DE of RM92bil, the budget deficit will drop to the targeted 3.5% in 2025 as per the 12MP. Based on these figures, Budget 2025 will increase by approximately RM21.2bil or 5.4% y-o-y to RM415bil as the total allocation for this year was at RM393.8bil.

The statutory debt-to-GDP ratio may reflect 62.4% and a federal government debt-to-GDP ratio of 64.5%, which is marginally higher than the 62.1% and 64.3%, respectively, achieved in 2023.

S&P Global Ratings, Moody’s Investors Services, and Fitch Ratings have presently placed Malaysia at A-, A3 and BBB+, respectively, and may upgrade Malaysia in terms of outlook to “positive”, followed by a likelihood of an upgrade in rating by a notch to A, A2 and A-, respectively.

This will be positive for the capital markets, as investors will be more willing to invest in both the fixed-income and equity markets, allowing the ringgit to improve against major currencies even further and on its strength.

The bottom

line is that Malaysia must show fiscal discipline to win over institutional

investors and international rating agencies. This can be done via pragmatic and

bold measures under Budget 2025.

Reference:

The

importance of fiscal discipline, Pankaj C.

Kumar, Insight, The Star, 5 October 2024