Source:

https://www.brookings.edu

Thursday 30 September 2021

China’s “Lying Flat” Movement

Wednesday 29 September 2021

Are GLICs in Capital Intensive Sectors?

Source: https://www.mstar.com.my

Tuesday 28 September 2021

The Top Trends in Tech

As

all things digital continue to accelerate, and which technology trends matter

most for companies? To answer that question, McKinsey has developed a unique methodology to identify the ten trends most relevant

to competitive advantage and technology investments.

|

1. Next-level process automation and

virtualisation |

50%

of today’s work activities could be automated by 2025 |

|

2. Future of connectivity |

Up to 80% of global population could be reached by 5G

coverage by 2030 |

|

3. Distributed infrastructure |

>75% of enterprise-generated data will be processed

by edge or cloud computing by 2025 |

|

4. Next-generation computing |

>$1 trillion value potential of quantum-computing use cases

at full scale by 2035 |

|

5. Applied AI |

>75% of all digital-service touch points (eg. voice

assistants) will see improved usability, enriched personalization and

increased conversation |

|

6. Future of programming |

~30x

reduction in the working time required for software development and analytics |

|

7. Trust architecture |

~10%

of global GDP could be associated with blockchain by 2027 |

|

8. Bio revolution |

45x

cost reduction for sequencing the human genome has been achieved in the past

10 years |

|

9. Next-generation materials |

10x

growth in number of patents between 2008 and 2018 |

|

10. Future of clean technologies |

>75% of global energy will be produced by renewable

in 2050 |

Source: The top trends in tech-executive summary, McKinsey & Co

These trends may not represent the coolest, most bleeding-edge technologies. But they’re the ones drawing the most venture money, producing the most patent filings, and generating the biggest implications for how and where to compete and capabilities you need to accelerate performance.

In

the next decade, according to entrepreneur and futurist Peter Diamandis, we’ll

experience more progress than in the past 100 years combined, as technology

reshapes health and sciences, energy, transportation, and a wide range of other industries and domains.

The implications for corporations are broad. Consider the compressive

effects on value chain as manufacturers combine 3-D or 4-D printing with next

generation materials to produce for themselves what suppliers had previously

provided and eliminate the need for spare parts.

Watch retailers combine sensors, computer vision, AI, augmented reality, and immersive and spatial computing to wow customers with video-game-like experience designs. Imagine virtualised R&D functions in science-based industries like pharma and chemicals or a fully automated finance function in your company.

A recent McKinsey survey describes how, during the pandemic, technology further lowered

barriers to digital disruption, paving the way for more rapid, technology-driven-change.

Survey respondents in every sector say their companies face significant

vulnerabilities to profit structures, the ability to bundle products and

operations. That’s the price for progress!

Reference:

The top trends in Tech

(https://www.mckinsey.com)

Monday 27 September 2021

Are SMEs and Poverty Linked?

On September 20, 2021 Ismail Sabri told Parliament that a total of 580,000 households from the middle-income group have slipped into the bottom 40 percent (B40G category) due to the economic fallout caused by the Covid-19 pandemic.

This represents approximately 20 percent of the middle 40 percent (M40G group, which initially received a monthly income of between RM4,850 and RM10,959). The pandemic also saw the B40 group suffer a loss of income, resulting in the absolute poverty figure in Malaysia rising to 8.4 percent in 2020, compared with 5.6 percent in 2019.

This is based on data provided by the Department of Statistics Malaysia (DOSMG), which uses the current Poverty Line Income (PLIG) of RM2,208 per month.

The unemployment rate contributed to a reduction of the take-home income for those in the M40 and B40 categories.

This is the impact of SMEs shutting down. The Government still doesn’t get it. The Micro and SME sectors (MSME) accounts for 40% of the GDP and over 48% of total employment. Retail and tourism need minimum wage subsidies, up to end 2022. SMEs with more than 10 employees have bigger problems to stay afloat and meet monthly wages and rental. Never mind bank loans!

SME Association’s survey in August 2021, suggested 26% of SMEs have shut down; 34% reported business dropped by 50% (2020 vs. 2019) while 32% said turnover fell by less than 75% in May-July 2021 versus the same period in 2020.

For Budget 2022, the SMEs are looking for:

- Wage subsidy to at least June 2022;

- Rental subsidy up to June 2022;

- Access to working capital to be speedier; CGC guarantees will take 3-6 months to be effective, by then businesses are closed;

- Tax rate of 15% for first RM500,000 of taxable income would help build reserves; and

- Sales and service tax reduced to 4% from 6%, to boost consumer demand.

The Government has to be more private sector-centric if the economy is to be revived, re-booted, or restored. What does that mean?

There has to be more dialogue, idea generation and measures that can be implemented quickly. The early “wins” are for a loan moratorium, wage and rental subsidies. Then address sector-related issues from tourism, aviation to property. Otherwise, we have the proverbial “head-in-the-sand” approach!

Source:

https://smemalaysia.org

Friday 24 September 2021

AirAsia: Is the Worst Over?

Source:

https://www.airasia.com

Thursday 23 September 2021

China Evergrande’s Debt Woes Rise!

China’s second largest property developer is on the brink of collapse as it faces a deepening liquidity crisis. China Evergrande, which is currently overseeing almost 800 projects across 200 cities in China, has so far this year (2021) experienced a 75 per cent drop in its share price.

For over two decades, the developer expanded on the back of China’s sweeping urbanisation and aggressive leverage. The company has moved to divest assets in recent months after the firm struggled to service its debts after a crackdown on the property sector by China’s central government in Beijing. The developer is reported to have amassed $120 billion in debt and close to $300 billion in total liabilities.

Beijing’s “three red lines” policy is a trio of metrics that policymakers have enforced to encourage the property industry to de-leverage. Failure to meet these metrics means an inability to access new loans. In August, Beijing summoned Evergrande’s executives to discuss the fact it was short on two metrics and issued a warning that the company would need to reduce its debt risks and prioritise stability. After the meeting, the developer “promised” to follow Beijing’s orders and said it would disclose information in a “timely manner”, would not “spread rumours” in the market and would clarify “false information” as requested by the authorities.

Evergrande claims to employ 200,000 people and indirectly generates 3.8 million jobs in China. On the face of it, China Evergrande Group made progress cutting its debt load in the first half of the year. On closer examination, paying its dues got even harder.

The developer’s borrowings, or interest-bearing debt, fell to a five-year low as of June 30. But its overall liabilities rose to a near-record 1.97 trillion yuan ($305 billion), thanks mainly to swelling bills to suppliers. Cash and cash equivalents plunged to a six-year low. The upshot: Evergrande will need to accelerate asset sales and continue to aggressively discount apartment prices to generate enough cash to meet its obligations. Bonds tumbled after the world’s most indebted developer said it risks defaulting on borrowings if its all-out effort falls short.

Evergrande said it’s exploring the sale of interests in its listed electric vehicle and property services units, as well as other assets, and seeking to bring in new investors and renew borrowings. Sharp discounts to swiftly offload apartments cut into margins in the first half, helping push net income down 29% to 10.5 billion yuan, in line with an earlier profit warning. “The group has risks of defaults on borrowings and cases of litigation outside of its normal course of business,” the Shenzhen-based company said in the statement. “Shareholders and potential investors are advised to exercise caution when dealing in the securities of the group.”

With banks, suppliers and homebuyers exposed to the real estate

giant, any collapse could impact China’s economy. Regulators urged Evergrande

to resolve its debt woes in a rare public rebuke. Among Evergrande’s top

lenders are China Minsheng Banking Corp., Agricultural Bank of China Ltd. and

Industrial & Commercial Bank of China Ltd.

An Evergrande plan to renegotiate

payment deadlines with banks and other creditors has been approved by China's

Financial Stability and Development Committee according to Bloomberg. Banks

have yet to agree to the proposal, however, according to two people familiar

with the situation.

Analysts expect a creditors committee

to be formed to help the company tide over the crisis. Creditors’ committees

work a little differently in China than elsewhere. Rather than being set up

when a company requires restructuring, in China they typically form before

default and function as a forum for creditors to help keep companies alive.

They can collectively agree to roll over loans or extend new credit. It is also

the channel through which the authorities can exert pressure on all major

debtholders.

Close to 300 companies in China have

defaulted with possible severe economic repercussions. Hopefully, the Chinese

authorities can “engineer” a soft landing for the property sector to stave off

a major recession.

References:

1. China Evergrande’s debt woes mount, www.theurbandeveloper.com

2. Evergrande’s total liabilities swell to over

$300 billion, Bloomberg News, September 1, 2021

3. China Evergrande faces default test as bond

coupons come due, Narayanan Somasundaram, Nikkei Asia, September 14, 2021

Wednesday 22 September 2021

Is Malaysia’s Bodek Culture Unique?

Murray Hunter of Euroasiareview argued cogently (7 September 2021) about Malaysia’s bodek culture. He viewed the heart of the problem as the practice of excessive servility to gain favour from superiors – bodek.

Former Prime Minister, Abdullah Badawi, identified it and tried to fix it. He and Najib tried to overcome the problem through the Government Transformation Programme.

According to Murray, bodekship is the greatest single organisational dysfunction within Malaysia’s civil service. It compromises quality and integrity of management along with protection against corruption. He cites five reasons against the bodeking culture:

(i) Cover for corruption

Loyal employees under the patronage of superiors usually follow directions. This enables tenders to be manipulated, purchasing procedures skilfully by-passed, and using budget allocations at the leader’s prerogative without accountability.

(ii) Misinformation

Government reports, presentations and proposals are prepared and written to put issues in a most positive light. Most reports and presentations focus on providing glossy projections to hide reality. Statistics are routinely skewed, with the national poverty rate grossly under-estimated by bureaucrats for many years to make the government look good at eradicating poverty.

(iii) Wastage of time and resources

Too much time and too many resources are put into creating events, program launches, and openings to glorify and please superiors. These events take teams a long time to plan for no other reason than pleasing a senior civil servant. Premises rental, equipment hiring, food catering, printing, and buying special uniforms all drain public money.

iv) Destroying productivity and creativity

The energy and emotion put into continually placating superiors is draining. The cultural norm that officers won’t contradict their superiors, and the difficulty in putting up new ideas when superiors already have an agenda, suppresses the diversity of ideas within the civil service. The culture of silence is embedded in students at schools, where they are deterred from asking questions.

(v) Destroying the notion of teambuilding

Such practices destroy morale and motivation within many departments and agencies within the civil service. Placating superiors leads to internal stress which manifests in ulcers, stomach complaints, and even cancers. This is an area that has been gravely neglected in research and treatment.

So, is Murray correct? No, it is not a unique phenomenon to Malaysia or its civil service. I am not advocating it. But it is practised in GLCs, PLCs and SMEs, depending on its culture and leader. It is also practised in the U.S., U.K., China, Japan, India or Indonesia. It is prevalent in many cultures and societies that have feudal- hierarchical features.

Former President Trump loved bodeking. In fact, anyone not able to do so in the Republican Party will feel his wrath or displeasure. The same in China, Japan or India.

It is a phenomenon we all need to move away from if creativity, integrity, transparency and accountability are to be valued. The effort is huge, and it starts with the leader – be it the PM or President.

So, laying blame on the Malaysian civil service alone is not a fair proposition – we are all part of the problem. Perhaps Mr. Murray needs to view a re-run of ‘Yes Minister’ to fully appreciate how bodeking can be an art!

We, nevertheless,

need to set higher standards for our politicians, civil servants and corporate

leaders if we are to progress with maruah.

Source: https://myeidos.com

Reference:

Malaysia’s Bodek Culture: Ailment Compromises Integrity of Public

Administration – Analysis, Murray Hunter, September 7, 2021(https://www.eurasiareview.com)

Tuesday 21 September 2021

The 5 Fastest Growing Industries in the U.S. for the Future

Reference:

The 5 fastest growing

industries of the next decade, Jenna Ross,

(https://advisor.visualcapitalist.com), July 29,

2021

Monday 20 September 2021

Regime Change: An American Apple Pie?

Source: https://www.reddit.com

Friday 17 September 2021

Who Funds the FDA?

The Food and Drug Administration (FDA) has moved from an entirely taxpayer-funded entity to one increasingly funded by user fees paid by manufacturers that are being regulated. Today, close to 45% of its budget comes from these user fees that companies pay when they apply for approval of a medical device or drug.

Source: https://www.fda.gov

Americans in the early 20th century were outraged when they found out that manufacturers used poor-quality methods for producing food and medication, and used unsafe, ineffective and undisclosed addictive ingredients in medications. The resulting Food, Drug and Cosmetic Act of 1938 gave the taxpayer-funded Food and Drug Administration new authority to protect the U.S. consumer.

One of the FDA’s most shining successes occurred in the late 1950s when the agency refused to approve thalidomide. By 1960, 46 countries allowed pregnant women to use thalidomide to treat morning sickness, but the FDA refused on the grounds that the studies were insufficient to demonstrate safety. Debilitating birth defects resulting from thalidomide arose in Europe and elsewhere in 1961. President John F. Kennedy heralded the FDA in 1962 for its stance.

The FDA continued its work fully funded by U.S. taxpayers for many years until this model was upended by a new infectious disease. The first U.S. case of HIV-induced AIDS occurred in 1981. But there were long delays in approving HIV drugs.

In 1992, in response to intense pressure, Congress passed the Prescription Drug User Fee Act. It was signed into law by President George H.W. Bush.

With the act, the FDA moved from a fully taxpayer-funded entity to one funded through tax dollars and new prescription drug user fees. Manufacturers pay these fees when submitting applications to the FDA for drug review and annual user fees based on the number of approved drugs they have on the market. However, it is a complex formula with waivers, refunds and exemptions based on the category of drugs being approved and the total number of drugs in the manufacturers’ portfolio.

Over time, other user fees for generic, over-the-counter, bio-similar, animal and animal generic drugs, as well as for medical devices, were created. As time passed, the FDA’s funding has increasingly come from the industries that it regulates. Of the FDA’s total US$5.9 billion budget, 45% comes from user fees, but 65% of the funding for human drug regulatory activities are derived from user fees. These user fee programs must be reauthorized every five years by Congress, and the current agreement remains in effect through September 2022.

The FDA and the drug or device manufacturers negotiate the user fees. They also negotiate performance measures that the FDA has to meet to collect them. Performance measures include things such as how quickly the FDA responds to meeting requests, how quickly it generates correspondence, and how long it takes from submission of a new drug application until the FDA approves or refuses to approve a drug or product.

Because of the additional funding generated by user fees and performance measures that the FDA has to meet, the FDA is quicker and more willing to discuss what it wants to see in an application with manufacturers. It also offers clearer guidance for manufacturers. In 1987, it took 29 months from the time a new drug application was filed by the manufacturer for the FDA to decide whether to approve a medication in the U.S. In 2014, it only took 13 months and by 2018, it was down to 10 months.

Most recently, the COVID-19 pandemic has seen the FDA provide emergency use authorization for potential treatments in a matter of weeks, not months. The infrastructure and capacity to review the available information so rapidly is due in large part to the funding from user fees.

User fees are a viable way to shift some of the financial burden to manufacturers who stand to make money from the approval and sale of drugs in the lucrative U.S. market. Successes have occurred and provided U.S. citizens with medication more quickly than before.

However, without careful consideration of what is being negotiated, the FDA can become weak and ineffective, unable to protect its citizens from the next thalidomide. There are some signs that the pendulum may be swinging too far in the direction of the manufacturers. The FDA is insufficiently funded to protect consumers from other issues such as counterfeit drugs and dietary supplements because they cannot collect user fees to do so.

The model whether in the U.S. or Malaysia, has to have a balance in terms of funding – private and public. Otherwise, the regulatory agency will become the mouthpiece of Big Pharma!

Reference:

Why is the FDA funded in part by the companies it regulates (https://theconversation.com)

Thursday 16 September 2021

If You are a Malaysian...

Source:

https://nextnationalday.com

Wednesday 15 September 2021

Government Revenue Shortfall: Tax Reforms or More Debt?

The Ministry of Finance (MoF), in its inaugural Pre-Budget Statement (PBS) for Budget 2022 (released on Aug 31), noted that the revenue collection for the first half of 2021 (1H21) was lower than expected. The collection for the rest of the year is likely to be even less as many economic activities were halted due to the Movement Control Orders (MCOs).

In order to maintain its spending levels for stimulating domestic economic growth, the federal government would have to either borrow more or expand its tax base. Some tax consultants concur that tax reforms, including the reintroduction of the Goods and Services Tax (GST), are necessary to help replenish the nation’s coffers and reduce dependency on oil revenue.

PwC Malaysia tax leader Jagdev Singh highlighted that the government must initiate tax system reforms in order to broaden its tax base. “I believe that broadening the tax base is something that the government perhaps needs to consider. Because they cannot continuously increase its debt ratios, debt limit, and they cannot continuously run a (budget) deficit on and on. So the revenue side of things needs to be looked at and there need to be avenues to see how they increase the revenue,” he said.

The MoF has identified various measures which are being evaluated to increase tax revenue and enhance tax compliance, such as the Special Voluntary Disclosure Program (SVDP) for indirect taxes, the introduction of a Tax Compliance Certificate (TCC) as a pre-condition for tenderers to bid for government contracts, the implementation of a Tax Identification Number (TIN) system and review of tax treatments which have resulted in revenue leakages or harmful practice, as well as the support for the Organisation for Economic Cooperation and Development (OECD)’s Base Erosion and Profit Shifting (BEPS) 2.0 initiative, which is designed to address cross-border tax leakages and aggressive tax planning. But these are not going to address completely the revenue shortfall. Hence the question of raising debt level.

As at the end of June 2021, the federal Government's statutory debt level had risen to 56.8% to gross domestic product (GDP), which is still below the statutory limit of 60%.

In short, we should be ready to expect higher debt to GDP ratios, which include correspondingly a potential downward grading of Malaysia's rating. This should not necessarily be received negatively, as a downgrade can be cushioned by other long-term economic policies introduced by the government towards growth.

PwC Malaysia deals partner of economics and policy Patrick Tay viewed that although the rise in the statutory debt limit would make the credit agencies “nervous”, a ratings downgrade would not negatively affect that significantly as most government debts are denominated locally. And borrowings must be channelled to “quality spending”.

That’s the problem. Every Government Minister and MP will want some allocation to ensure their “survival” in the next general election. It is the same on the revenue/tax side, no MP wants to see any increase in tax, where constituents are impacted.

Can’t the Government look at excess profit (or some others) for sectors advantaged by Covid-19? Can’t the Government apply prudence and remove wastage in its expenditure? Why can’t we have an Independent Tax and Expenditure Commission to review, reform and restore Government finances?

Reference:

Expected shortfall in govt revenue calls for tax system reforms, raising statutory debt limit, Emir Zainul, TheEdgeMarkets.com

Tuesday 14 September 2021

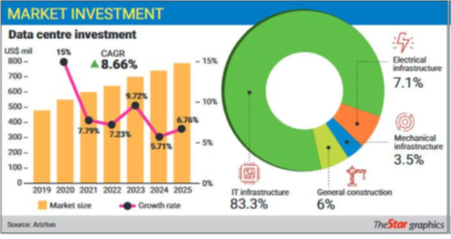

Are Hyperscale Data Centres (“HDC”) Moving to Malaysia?

According to a Starbizweek report (28/8/21), global giants in cloud computing and hosting are looking at Malaysia to have their data centres. These include Amazon, Microsoft, Google and Tencent. Many of these global tech players have their data centres in Singapore. However, about two years ago Singapore began limiting approvals for HDCs. Why? HDC consumes large amounts of electricity, water and space.

What is a HDC? Some classify this as any data centre with at least 5,000 servers and 10,000 square feet of available space. Others focus less on physical attributes and more on “scale of business” criteria – company’s cloud, e-commerce and social media operations. There are almost 600 centres in the world.

The global market size of colocation data centres is estimated to reach US$92.4bil RM387.2bil) in 2025. Asia-Pacific alone will account for 50% of the global market by revenue and 40% by MW in 2025 globally.

Dr James Tee of G3 Global Bhd says “Malaysia now has a one-in-a-lifetime opportunity. The global market size of colocation data centres is estimated to reach US$92.4bil (RM387.2bil) in 2025. Asia-Pacific alone will account for 50% of the global market by revenue and 40% by MW in 2025 globally,” he says. Adds Tee: “Malaysia is in an opportune position to be a part of this growth. Reports indicate that Malaysia can expect a compounded annual growth rate (CAGR) for HDCs of 13% between 2019 to 2025. This is supported by the fact that our domestic data centre industry revenue has been growing at a CAGR of 22% from 2011 to 2020.” (Starbizweek 28 August 2021).

Research outfit Arizton Advisory reckons that Malaysia’s data centre market size will reach revenues of a massive US$1.4bil (RM5.8bil) by 2026. The state of Johor is becoming one hotspot. Microsoft and GDS are among those building new HDCs there.

Johor appeals to some large tech players already in Singapore because of the availability of high data speed connections between Johor and Singapore. Lower cost is another obvious reason.

G3 Global Bhd said it plans to house the country’s largest HDC in the proposed Artificial Intelligence (AI) park in Bukit Jalil, starting with three 10MW hyperscale data centres in the first phase of development. At maturity, the data centres are meant to have a potential end state of 100MW.

There is a huge opportunity for AI to flourish in Malaysia and the government recognises its potential in the nation’s growth. Among the work-in-progress are securing data centre partners, equipping the park with 5G technology and securing strategic investors.

But Malaysia is not alone in trying to woo such investments. Aside from Singapore, which is the data centre hub in the region, Indonesia and Thailand are also in the running for this business.

A recent research report notes that the Indonesia data centre market was valued at US$1.5bil (RM6.28bil) in 2020, and it is expected to reach a value of US$3.07bil (RM12.86bil) by 2026, registering a CAGR of 12.95% over 2021 to 2026. The report indicates that the potential for data centre growth in Indonesia is significant as the country is witnessing a growing digital economy, coupled with the rapid growth of startup companies and an ever-growing population.

The Thailand data centre market includes about 14 unique third-party data centre service providers, operating more than 30 facilities. In addition, there are also several on-premises or dedicated data centres owned by local enterprises.

Detractors caution that simply opening up Malaysia’s shores to large foreign tech giants to set up their HDCs here brings questionable value. These detractors who are from the local data centre industry, worry that Malaysia would end up becoming a “HDC sweatshop”. They point out that HDCs do not hire many people, due to the highly automated nature of the systems. Another concern is a huge amount of the investment actually goes out of Malaysia as the HDC would be purchasing computer hardware and software that isn’t made in Malaysia to be placed into the HDCs here.

Whatever the case, on balance, if FDIs move into Malaysia that is a positive development (amidst the gloom of negative news). Will MITI or MIDA work harder to secure these investments? Otherwise, Indonesia or Thailand will prove more alluring!

Reference:

Striking while the iron is hot, Zunaira Saieed, Starbizweek, The Star, 28 August 2021

Monday 13 September 2021

Did the U.S. Lie About Afghanistan?

- Approximately $19 billion in U.S. taxpayer dollars fell into the hands of the Taliban and allied groups, according to a study of Defence Department contracts in the country.

- The head of a construction firm had a brother in the Taliban. One brother would build infrastructure projects, and the other would destroy them, so the first would get the U.S. contract to rebuild.

- Ryan Crocker, the former U.S. ambassador to the country, said bluntly of the Afghan police force that the U.S. trained and funded: “They are useless as a security force … because they are corrupt down to a patrol level.”

- As the Taliban gained ground in 2018, the U.S. stopped keeping track of how much territory both the Afghan government and Taliban controlled. It was too embarrassing.

- Americans were deeply ignorant of Afghanistan’s culture, leading to scenes out of some dark comedy. Afghans mistook urinals on military bases for drinking fountains, according to one U.S. military official.

- Corruption at all levels;

- Cultural differences;

- Will power;

- Intelligence failures;

- Lack of clear objectives;

- No adequate support on military hardware – i.e. the “software” was not developed to fly the planes or helicopters;

- Leadership deficit at both American and Afghan forces;

- Not neutralising the safe havens of Pakistan and Iran (for the Taliban); and

- Clear determination of who re-armed and trained the Taliban?

Source:https://www.usatoday.com