Of the many businesses impacted by Covid-19, the hotel industry is an obvious victim. Low occupancy in 2020 has led to massive losses. This will continue in 2021. The outlook could only improve with MCO being lifted and travel restrictions removed.

Many owners are looking at sale, merger or closure. Those cash-rich buyers are waiting for further price collapse. Listings for hotels for sale in Malaysia have jumped 40% while prices have dropped by 35% from pre-pandemic days, according to Zerin Properties. Buyers are looking at hotels in Kuala Lumpur, Penang, Langkawi, Kota Kinabalu, Johor Bahru and Desaru.

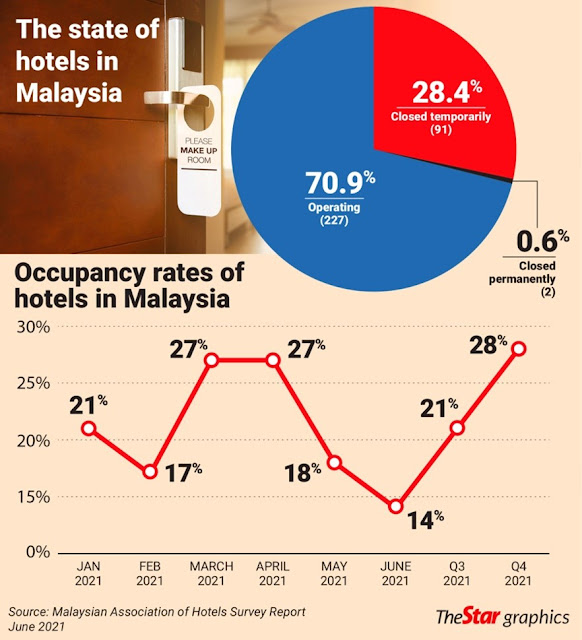

The Malaysia Association of Hotels (“MAH”) notes average hotel occupancy stood at 32% in 2020. This is as compared to 64% in 2019 and 61% in 2018. For 2021, occupancy will drop further to 23%. The hotel sector has lost RM300 million in revenue for every two weeks of MCO. The total loss for 2020 was RM6 billion in 2020. For first half of 2021, the loss is estimated at RM5 billion. If travel restrictions are allowed, occupancy levels may improve to 35% in 2022. That’s another year of losses.

The average daily rate (“ADR) for 2021 is between RM180-RM190, a drop of 20%-30% compared to pre-pandemic levels. Mid to upper luxury hotels had at least 50% reduction in ADRs. As a result many closed. The Istana Hotel will shut by September 1, 2021 after operating since 1992. The Equatorial Hotel Penang in Bukit Jambul will also close soon. Shangri-la Hotels saw a massive drop of 74% in its revenue. It posted a loss of Rm19.6 million (Q1 ’21) compared to a profit of RM2 million in previous corresponding period. Shangri-la Kuala Lumpur’s occupancy was only 7% in Q1 ’21 from 35% in 2020.

There are over 4,500 hotels registered with the Ministry of Tourism. Many are small outfits. Around 140 are 5-star hotels and 220 are 4-star ones.

A survey of 320 hotels by MAH whowed 91 have closed temporarily, and 2 closed permanently.

In Johor, 13 hotels have suspended operations, while 23 closed in Langkawi.

Of the 320 surveyed, 71% are staying afloat, some acting as quarantine centres. Many owners have re-strategised by lowering operational costs and consolidating resources. Those with adequate funds, turn to refurbishment and renovation for possible better times ahead. This is a minority. Others have resorted to have delivery of their cuisines. But this cannot save the sector. They need help on electricity bills and loan moratorium, beyond other operational issues.

The survival of hotels in Malaysia will depend on available cash resources, accommodative Government policies and lifting of movement restrictions. Otherwise, it is more mergers and acquisitions or closures.

Reference:

Hotel industry’s defining moment, Zunaira Saieed, Starbizweek, The Star, 24 July 2021

No comments:

Post a Comment