The virtual Malaysian Property Summit 2021 had a consensus that the market next year (2022) will continue on its path to recovery and hopefully, reach pre-pandemic levels. This was reported by Eugene Mahalingam in Starbizweek, 16 October 2021.

Rahim & Co research director Sulaiman Akhmady Mohd Saheh said the gradual reopening of the economy will help spur the property sector. Additionally, Sulaiman said increased vaccination rates, easing physical containment measures and build-up in financial savings from 2020’s expenditure-suppressed period, will spur consumer sentiment.

Going into 2022, Datametrics Research and Information Centre managing director Pankaj Kumar said domestic interest rates are expected to remain stable and supportive of market activities. “The property market today is a buyers’ and renters’ market. However, household income will need to revert back to 2019 levels and rise, before affordability can be improved.”

Pankaj is hopeful that the ongoing Home Ownership Campaign (HOC) will be extended into 2022 and comprise the secondary market as well. Currently, the HOC is only applicable for properties within the primary market.

Meanwhile, Sunway University economics professor Yeah Kim Leng said the local property market is expected to experience a rebound in 2022, on the back of the stronger economic performance forecast for next year.

Yeah however adds that there is still an undersupply of affordable housing and oversupply of high-end units being launched. This oversupply of units has led to a serious overhang situation that the Malaysian property market has had a tough time resolving for many years.

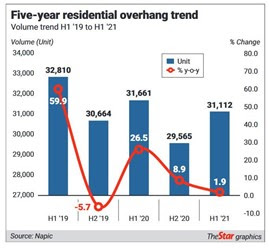

According to the National Property Information Centre (Napic), a total of 31,112 overhang units worth RM20.09bil was recorded in the first half of 2021. This was an increase of 5.2% and 6.2% in volume and value respectively, against the preceding half.

The serviced apartment sub-sector, meanwhile, recorded 24,064 overhang units with a value of RM20.41bil in the first six months of this year, indicating a marginal increase of 1.9% in volume. However, value declined by 10.2% compared to the preceding half.

Meanwhile, the unsold, under construction recorded 42,358 units, an increase of 20.1%. To address the overhang situation in the country, the government kicked off the HOC in January 2019. The campaign, which was intended for six months, was extended for a year.

It generated sales totalling RM23.2bil in 2019, surpassing the government’s initial target of RM17bil.

The government reintroduced the HOC in June last year under the Penjana initiative to boost the property market after it was adversely affected by the Covid-19 pandemic. The campaign was extended to the end of this year, with property consultants and developers fully supporting the move.

In March this year, during the Real Estate and Housing Developers’ Association’s briefing on the property market for 2021, its president Datuk Soam Heng Choon revealed that since the HOC was reintroduced last June, a total of 34,354 residential units valued at RM25.65bil had been sold as at Feb 28, 2021.

To curb the overhang situation, Pankaj says developers need to focus on what the market wants. Khong & Jaafar managing director Elvin Fernandez also says one can’t just randomly freeze a particular project once it has been greenlit.

Elvin believes that the power to address the overhang situation rests with the local authorities and the banks. “The local authorities should demand an independent market study from the developer, prior to providing a development order to developers. “Similarly, the banks should also demand the same (an independent market study) from developers before approving a loan”. “Therefore, both these bodies (local authorities and banks) need to play a role in determining supply.” Meanwhile, TA Securities anticipates the upcoming Budget 2022 to be primarily helpful to low-to-middle-income earners, as well as to first-time home owners.

Budget 2022 will be tabled on Oct 29. Unless the Budget provides “goodies” for the property sector, recovery is likely to be slow. The MoF has many sectors to assist and property is not its prime interest. So, 2022 is likely to be a slow year, with mid-2023 or early 2024 more likely to reach pre-pandemic levels in terms of transactions. That’s not good news to the sector but the reality has to be met.

Reference:

Property market seen to bounce back in 2022, Eugene Mahalingam, Starbizweek, 16 October 2021.

No comments:

Post a Comment