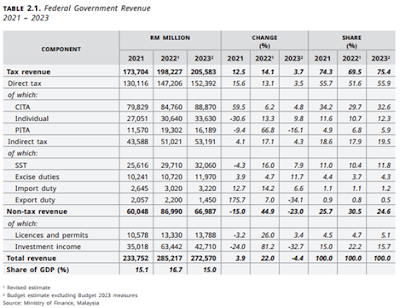

Federal Government revenue in 2022 has been projected to increase significantly by 22% to RM285.2 billion or 16.7% of GDP contributed by both tax and non-tax revenue. Tax revenue remains as the major contributor at 69.5% of total revenue or 11.6% of GDP, driven by strong economic recovery and higher commodity prices. Non-tax revenue collection is expected to increase its share of total revenue from 25.7% in 2021 to 30.5% in 2022 on account of higher dividend payment.

Tax revenue is projected to grow by 14.1% to RM198.2 billion with both direct tax and indirect tax are estimated to register double-digit growth. Direct tax collection is forecast to grow by 13.1% to RM147.2 billion, contributed mainly by higher companies income tax (CITA) collection at RM84.8 billion resulting from higher corporate earnings following the strong economic recovery.

Non-tax revenue is expected to surge by 44.9% to RM87 billion, largely contributed by higher proceeds from interest and return on investments. The bulk of the proceeds is from PETRONAS dividend totalling RM50 billion, of which RM25 billion is an additional dividend resulting from better profitability, while dividend from Bank Negara Malaysia amounted to RM5 billion.

For 2023, Malaysia’s expected economic growth between 4% to 5% coupled with the anticipated moderation in global commodity prices, will result in a slower growth of the Federal Government’s tax revenue at 3.7% amounting to RM205.6 billion or 11.3% of GDP. However, non-tax revenue is estimated to decline to RM67 billion or 3.7% of GDP, offsetting the increase in tax revenue. Consequently, the Federal Government’s revenue is projected to decline by 4.4% to RM272.6 billion. Direct tax is estimated to increase by 3.5% to RM152.4 billion, representing 74.1% of total tax revenue. The bulk of the increase is attributed to better collection.

Indirect tax is estimated to increase by 4.3% to RM53.2 billion in tandem with steady consumption and trade growth. SST is forecast to record RM32 billion or about 1.8% of GDP.

Non-tax revenue is estimated to decline by 23% to RM67 billion or 3.7% of GDP. The lower collection is due to lower proceeds from investment income, particularly dividend from PETRONAS which is projected to be lower at RM35 billion.

No comments:

Post a Comment