According to World Investment Report (2019), Global

foreign direct investment (FDI) flows continued their slide in 2018, falling by

13 per cent to $1.3 trillion (figure 1). The decline – the third consecutive

year’s fall in FDI – was mainly due to large-scale repatriations of accumulated

foreign earnings by United States multinational enterprises (MNEs) in the first

two quarters of 2018, following tax reforms introduced in that country at the

end of 2017. The tax-driven fall in the first half of 2018 (which ended 40 per

cent lower than the same period in 2017) was cushioned in the second half by

increased transaction activity.

The

value of cross-border merger and acquisitions (M&As) rose by 18 per cent,

fuelled by United States MNEs using liquidity in foreign affiliates that was no

longer encumbered by tax liabilities.

FDI

flows to developed economies reached their lowest point since 2004, declining

by 27 per cent, whereas flows to developing economies remained stable, rising

by 2 per cent to $706 billion. As a result of the increase and the anomalous

fall in developed countries, the share of developing economies in global FDI

increased to 54 per cent, a record. Their presence among the top 20 host

economies remained unchanged (figure 2). The United States remained the largest

recipient of FDI, followed by China, Hong Kong (China) and Singapore.

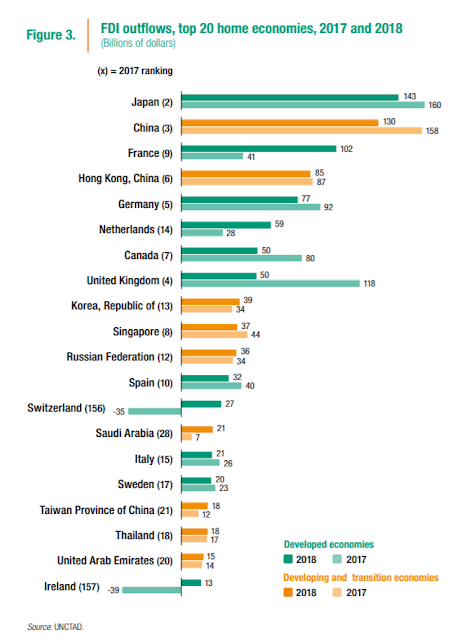

Overall,

outward FDI from developed countries as a group fell by 40 per cent to $558

billion. As a result, their share in global outward FDI dropped to 55 per cent

– the lowest ever recorded. Outward investment by MNEs from developing

economies declined by 10 per cent to $417 billion. Outflows from developing

Asia fell by 3 per cent to $401 billion.

In

2019, FDI is expected to see a rebound in developed economies as the effect of

the United States tax reform winds down. Greenfield project announcements –

indicating forward spending plans – also point at an increase, as they were up

41 per cent in 2018 from their low 2017 levels.

Despite

positive indicators such as tax reform and greenfield project announcements,

projections for global FDI show only a modest recovery of 10 per cent to about

$1.5 trillion, below the average over the past 10 years. Growth potential is

limited because the underlying FDI trend remains weak. Trade tensions also pose

a downward risk for 2019 and beyond.

Reference:

United

Nations, World Investment Report 2019 – Special Economic Zones

No comments:

Post a Comment