In

a previous article, we introduced the CFA Institute Investment Foundation

Program (Read

more here). It is a free program

designed for anyone who wants to enter or advance within the investment

management industry, including IT, operations, accounting, administration, and

marketing. Candidates who successfully

pass the online exam earn the CFA Institute Investment Foundations Certificate.

There

are total of 20 Chapters in 7 modules, covering all the essential topics in

finance, economics, ethics and regulations.

This series of articles will highlight the core knowledge of each

chapter.

Chapter

14 provides an overview of Investment Vehicles. The learning outcome of chapter

14 is as follows:

·

Compare

direct and indirect investing in securities and assets;

·

Distinguish

between pooled investments, including open-end mutual funds, closed-end funds,

and exchange-traded funds;

·

Describe

security market indices including their construction and valuation, and

identify types of indices;

·

Describe

index funds, including their purposes and construction;

·

Describe

hedge funds;

·

Describe

funds of funds;

·

Describe

managed accounts;

·

Describe

tax-advantaged accounts and describe the use of taxable accounts to manage tax

liabilities.

Index

funds, which are passively managed, are among the most common types of pooled

investment vehicles and are used widely in most parts of the world. They are

popular because they provide broad exposure to an asset class and are cheap

relative to many other products.

A

security market index is a group of securities representing a given security

market, market segment, or asset class. The security market indices just

mentioned are widely published equity market indices. Practitioners have also

created many other indices. They are popular because they provide broad

exposure to an asset class and are cheap relative to many other products.

A

price-weighted index is an index in which the weight assigned to each security

is determined by dividing the price of the security by the sum of all the prices

of the securities. As a consequence, high-priced securities have a greater

weighting and more of an effect on the value of the index than low-priced

stocks. The DJIA in the United States and the Nikkei 225 in Japan are examples

of price-weighted indices.

Many

indices are capitalisation-weighted indices (also known as cap-weighted

indices, market-weighted indices, or value-weighted indices). The weight

assigned to each security depends on the security’s market capitalisation.

Market capitalisation is equal to the market price of the security multiplied

by the number of shares outstanding of the security. The Hang Seng in Hong Kong SAR, the FTSE 100

in the United Kingdom, and the S&P 500 Market Weight Index are examples of capitalisation-weighted

indices.

Equal-weighted

indices show what returns would be made if an equal value were invested in each

security included in the index. The prices of these securities change

continuously. Thus, to maintain the equal weights between securities, regular

index rebalancing is necessary. That is, the weights given to securities whose

prices have risen must be decreased, and the weights given to securities whose

prices have fallen must be increased. The S&P 500 Equal Weight Index is an

example of an equal-weighted index.

An

index fund is a portfolio of securities structured to track the returns of a

specific index called the benchmark index. An index fund is a passive

investment strategy because the index fund manager aims to replicate the

benchmark index.

Hedge

funds are private investment pools that investment managers organise and

manage. As a group, they pursue diverse strategies. The term “hedge” once

referred to the practice of buying one asset and selling a correlated asset to

take advantage of the difference in their values without taking much market

risk—thus the use of the term hedge because it refers to a reduction or

elimination of market risk. Although many hedge funds do engage in some

hedging, it is not the distinguishing characteristic of most hedge funds today.

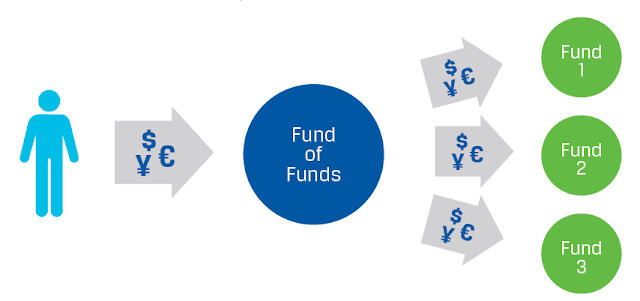

Funds

of funds are investment vehicles that invest in other funds. They can be

actively managed or passively managed.

Two main investment strategies characterise most actively managed funds

of funds. Some managers try to identify funds with managers they believe will

outperform the market. They then invest in funds managed by those managers.

Others use various proprietary models to predict which investment strategies

are most likely to be successful in the future and then invest in funds that

implement those strategies. Both types of managers try to hold well-diversified

portfolios of funds to reduce the overall risk of their funds.

The

costs of investing in an actively managed fund of funds can be high because

investors pay two levels of fees. They pay management and performance fees

directly to the fund of funds manager and they also indirectly pay fees to the

managers of the funds in which the fund of funds invests.

To

promote savings for retirement income, educational expenses, and health

expenses, many countries give tax advantages to certain investment accounts.

In

general, tax-advantaged accounts allow investors to avoid paying taxes on

investment income and capital gains as they earn them. In addition,

contributions made to these accounts may have tax advantages. In exchange for

these privileges, investors must accept stringent restrictions on when the

money can be withdrawn from the account and sometimes on how the money can be

used.

Investors

in taxable accounts can often minimise their tax liabilities through careful

investment management decisions. In particular, most jurisdictions do not tax

capital gains until they are realised.

No comments:

Post a Comment