Quantitative easing (QE) is an indirect

method of printing of money. In a narrow sense, “printing money” is increasing

the volume of money in circulation i.e. now it is more of electronic money. In

a wider sense, “printing money” is any type of expansionary monetary policy to

stimulate an economy, increase inflation and employment. So, in that wider

sense, reducing interest rates, decreasing liquidity or reserve requirements,

easing collateral requirements and QE are all tools at the disposal of a

central bank.

QE does increase money supply, but it

takes time and may not help if borrowers are not keen to borrow. Why? Business

outlook may look rather bleak or/and banks remain cautious in their lending.

Where the central bank purchases financial

assets from financial institutions, which is almost always government bonds, it

is paid for by creating new central bank reserves. QE therefore simultaneously

increases amount of central bank money and amount of commercial bank money

(deposits in bank accounts). Only the deposits can be spent in the real

economy.

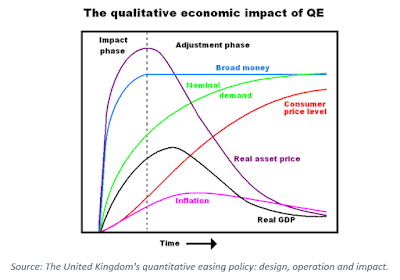

Quantitative easing affects the economy

in several ways:

·

Credit

channel – providing liquidity;

·

Portfolio

rebalancing – private investors turn to other securities;

·

Exchange

rate – leads to weaker currency and improves exports;

·

Fiscal

effect – cheaper for Government to borrow; and

· Signalling

effect – suggests the central bank will take extraordinary measures to

facilitate recovery.

The Federal Reserve (Fed) has been

unstoppable in expanding its balance sheet. It has now reached USD7.04

trillion, because of Covid -19. The Fed has now announced plans to purchase

corporate debts and high yield ETFs. Many corporates are therefore rushing to

raise new capital, knowing that the Fed is there to provide a backstop. What

about moral hazard? What if the companies do not survive the economic turmoil?

Why was QE not effective in boosting

GDP?

The newly created money, as said earlier,

goes into the financial markets— basically, bonds and stocks. The Bank of

England (BoE) estimates that QE boosted bond and share prices by around 20%. In

theory, people who are now wealthier should spend more. However, 40% of the

stock market in the U.K. is owned by the wealthiest 5% of the population. While

most families saw no benefit from QE, the richest 5% of households would have

been better off.

Very little money created through QE in

the U.K. has boosted the real (non-financial) economy. BoE estimates that the

first £ 375 billion of new money created just £23-£28 billion of extra spending

in the real economy (or 1.5-2.0 GDP growth). It is incredibly ineffective. And

it relies on a “trickle down” theory of wealth.

A more effective way to boost the real

economy is for BoE to create money and grant it to the Government and allow it

to spend directly into the economy. This could be for infrastructure or sectors

with high economic linkages that create employment and all the multiplier effects.

What’s stopping a government from doing

so?

Fiscal prudence or prescribed debt

ceilings imposed by various Parliaments. Then you have analysts and economists

raising concerns on the ratio of debt to equity. Reinhart and Rogoff have found

that debt to GDP above 90% impacts negatively growth rate of a country.

In this Covid situation, temporary or limited

exemptions need to be provided where debt to GDP is well below 90%. Otherwise,

there is negative growth and outlook. Private investment or consumption will be

limited hence it is time for the public sector to play the more dynamic role or

catalyst.

References

1.

How

Quantitative Easing Works, Positive Money.

2.

The

Market is Fed, Pankaj C. Kumar, Starbiz Week, Saturday 23 May 2020.

No comments:

Post a Comment